Reddit: High Growth, Big Expectations

Can Reddit deliver on its growth promises and justify its valuation? Let’s unpack the key metrics and risks.

Reddit is delivering impressive growth, with revenue surging 68% YoY and gross margins hitting an enviable 90.1%. The company is showing solid progress in EBITDA and Net Income, driven by key initiatives like machine translation, local community engagement, and an expanding ad business. These efforts are fueling both user growth and ARPU (average revenue per user), creating a compelling growth narrative.

Looking ahead to 2025, management plans to double down on new product development, global market expansion, and further bolstering its advertising platform. With an asset-light model and low CapEx requirements, Reddit is generating robust Free Cash Flow ($70M last quarter) even at modest net margins, signaling strong operational efficiency.

A Closer Look at Valuation

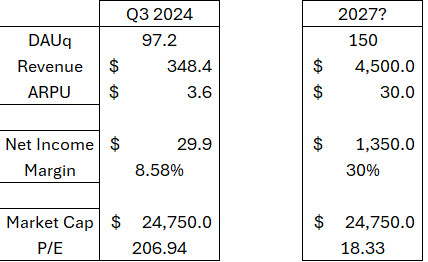

At a $25B valuation, Reddit’s pricing reflects its high-growth potential. But is it justified? Traditional P/E metrics don’t tell the full story, given Reddit’s stage of growth. Instead, let’s look at a hypothetical scenario:

150M users (up from the current ~100M).

ARPU increasing from $3.58 per quarter to $7.5.

Net Income Margin scaling from 8.5% to 15%.

Under these assumptions, Reddit would trade at 36x earnings—reasonable for a growth stock. However, the timeline matters. Achieving these milestones by 2025 makes Reddit an attractive investment. If delayed to 2027 or beyond, the opportunity cost increases, making the current valuation less appealing.

Long-Term Upside

The high gross margin leaves room for significant margin expansion. If Reddit can eventually achieve a 30% net margin—similar to Meta—it could trade at a much lower P/E, potentially below 20x. This level of profitability isn’t likely in the short term but is feasible with continued growth and scaling.

Source: Author

There’s additional upside if Reddit surpasses ARPU expectations or accelerates revenue growth, but these depend on flawless execution.

Final Thoughts

Reddit is a growth story worth monitoring. While its current valuation is steep, the company’s operational efficiency, strong margins, and potential to scale make it intriguing. If Reddit delivers faster-than-expected growth or margin expansion, it could become a highly compelling investment sooner than anticipated.

Source: Koyfin

Key Takeaways:

Strong Growth but High Expectations: Revenue grew 68% YoY with a 90% gross margin, but the $25B valuation demands sustained growth in users and ARPU.

Positive Cash Flow: Reddit generates solid Free Cash Flow despite modest net margins, showcasing operational strength.

Risks and Rewards: Success hinges on meeting aggressive growth targets. Faster growth or margin surprises could unlock upside, but delays reduce investment appeal.

TrendSpider Is One of The Best Trading Tools and BLACK FRIDAY DEALS ARE HERE 👇

Buy Now to Maximize Your Savings

Your Choice: Start a Free Trial with Modest Savings or Skip the Trial and Buy Now for the Deepest Discount!

Award-Winning 🏆 Industry-Leading 🚀 All-in-One Trading Platform

Real-Time Charting, Scanning, Backtesting, Alerts, Bots, Fundamentals, Options Flow & more!

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always conduct your own research or consult with a licensed financial advisor before making any investment decisions. The views expressed are my own and reflect personal opinions, not recommendations. Investing involves risks, and you should carefully consider your financial situation and risk tolerance before engaging in any financial transactions.